Real World Lease Examples and Calculations

In this chapter:

1. Cap Cost Is Important

Don't let the dealer tell you not to worry about the cap cost because it doesn't affect you. It does! It makes a difference in your payments. They keep quoting monthly payments as a distraction. Pay attention to the value of the entire deal.

2. How Your Monthly Lease Payment is Calculated

There are 3 components:- Monthly Depreciation Fee = ( Net Cap Cost - Residual ) ÷ Lease Term

- Monthly Finance Charge = ( Net Cap Cost + Residual ) x Money Factor

- Sales Tax (Depreciation Fee + Finance Fee) x Tax Rate

In states like Illinois, Texas and a few others, they tax you according to the gross cap cost up front. This is very unfair because you are only using about 50% equity then returning the vehicle.

Example

Assume you lease a car for 36 months, with an adjusted cap cost of $35,000. They give you a residual of 54% after 36 months ($18,900). You can verify this too if you have the ALG Lease Residual Value Software. They disclose the money factor is .00333 (equivalent to 8% APR).

- Monthly Depreciation Fee = ( $35,000 - $18,900 ) ÷ 36 = $447.22

- Monthly Finance Charge = ( $35,000 + $18,900 ) x .00333 = $179.49

- Sales Tax = ($447.22 + $179.49) x .06 (Florida Tax is 6%) = $37.60

Total Monthly Payment = $447.22 + $179.49 + $37.60 = $664.31

Over 36 months it will cost you $23,915. If you buy the car at the end at its $18,900 residual value, your total cost would be $42,815 + up front fees (bank fee, dealer service fee, security, etc.) Buying is usually cheaper in the long run. If you had bought the car with 8% APR over the same 3 years your monthly payments would be $1,162.57, but your total cost is only $41,852.84.

Lease Calculator Spreadsheet Download

I created an Excel spreadsheet to calculate your lease payments (click here to download it). I based it on the FTC's Regulation M Model Lease form with several enhancements. I highly suggest that you download it and get practice with it on an old lease or some of the examples on this page. The enhancements I made are the inclusion of the money factor and lines for other closing costs like dealer acquisition. It will show you how much the entire lease will cost you. This is what dealers never tell you. The instructions are on the "Instructions" tab. Even better than this spreadsheet though, is the Expert Lease Pro Software that has the ALG Residual Values built right into it. You will need this software to accurately calculate Ford leases which are slightly different due to their "hidden" money factors which makes my spreadsheet off for them.

You'll notice in the spreadsheet I made no cell for you to enter MSRP. You never want to see MSRP listed on the lease because you want a negotiated cap cost that is less than MSRP. The only thing MSRP is used for is calculating the residual value but the spreadsheet just allows you to enter the calculated residual value.

3. Real World Example #1

Here's one from a visitor who emailed me to say how they got scammed. Before going in, the buyer researched all the prices and calculated the numbers in the table below. The dealer also calculated the numbers and showed them a lower monthly payment. Good deal right? Wrong! Examine the costs in the table:

| Item | What the buyer calculated | What the dealer calculated |

| MSRP | $22,600 | $22,600 |

| Best Deal | $20,800 | $23,000 ($400 over MSRP!) |

| Registration Fee | $500 | $500 |

| Gross Capitalized Cost | $21,300 | $23,500 |

| Residual (% * MSRP) | $12,430 (55%) | $14,012 (62%) |

| Down Payment | $3,500 | $4,297 |

| Adjusted Cap Cost | $17,800 | $19,203 |

| Depreciation during lease | $5,370 | $5,191 |

| Money Factor | .00316 (7.58%) | .002844 (6.82%) |

| Monthly Payment (incl. 7% tax) | $262 | $257 |

| Total Cost Of Lease (cash down + payments) | $12,932 | $13,549 |

| Total Lease (if car is bought at end) | $25,272 | $27,598 |

This is a textbook scam. Notice the items in red? The salesman overcharged them. The monthly payments were less, so the salesman had the buyer's attention focused on the payments, instead of the big picture. The buyer had no idea the dealer charged him $400 over MSRP! Also, the dealer required $797 additional cash down which reduces the cap cost even further. The buyer's loss is $617 on the Total Cost Of Lease in the table. How are the payments lower? They increased cash down to $4,297, artificially inflated the residual value so the depreciation would be less and used a slightly lower money factor.

Real World Example #2

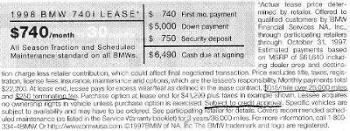

Here's an ad for a 30 month lease. At least they disclose what you need at inception (over $6,490 to close). This high down payment is used to reduce the cap cost, thus making you think your payments are low. They divert your attention to "low" monthly payments. Why would you want to put down so much cash on a car that you don't own?

I filled out my Regulation M Model Lease spreadsheet for this example. Click here to download it and view while you read the comments below.

The fine print in ad mentions the "sale price" of the car is full MSRP ($61,640). I researched and found dealer invoice was only $54,495! They also get a 2% holdback from the factory of $1,232. This means the dealer only paid $54,494 - $1,232 = $53,263 and they'll profit $8,377! Are you seeing red yet?

Also, the fine print says the "payment excludes taxes" so add Florida 6% tax to $740. Now your real monthly payment is $784. The fine print says you are limited to 25,000 miles during the 30 month lease, which is how they hide the ridiculous 10,000 mile/year limit. Also, you have to pay a $250 termination fee when you turn in the car. What do you think are the chances that you'll get your $750 security deposit back? They could find $850 worth of excess wear and tear. And here's my favorite, "subject to credit approval." This means it's unlikely you'll enjoy this great deal.

Let's check their math by looking at the spreadsheet I filled out. It was pretty easy, but they did not supply us with the money factor so let's figure it out.

Monthly Depreciation Fee = (Net Cap Cost - Residual) ÷ Lease Term

($56,640 - $41,299) ÷ 30 = $511.37

Subtract this from the $740 pre tax monthly payment to get the Monthly Finance Charge $740 - $511.37 = $228.63

Next,

Monthly Finance Charge = (Net Cap Cost + Residual) x Money Factor.

$228.63 = ($56,640 + $41,299) x Money Factor

Now remembering algebra Money Factor = $228.63 ÷ $97,939

So, the Money Factor is .002335

Now you can see everything jibes with their numbers, including the monthly payment and the total of all the monthly payments in the brown section.

Look at the total cost of the lease in the orange section. Notice how it's almost $29,000? That's how much it is costing you with the monthly payments, cash down, taxes, fees, etc. The ad states the monthly payments add up to $22,200, but your brain tricks you into thinking that's how much your total cost will be. But we aren't done yet, folks. You know there's going to be title fees and registration fees. If you know these numbers for your state, just fill them in.

5. Negotiate Your Lease

The $61,640 from the ad is the gross cap cost. This is where you should negotiate down to near invoice, which is $54,495. If you had done this, your monthly payments would have been about $260 less! The dealer still gets a $1,232 holdback, not bad for a few hours work. They'll cry on your shoulder that they paid over $55,000 for the car. This is not true. They borrowed the money for the car at a low interest rate and are paying an average floor plan interest of about $150 per month for every car on the lot. By offering them the deal at invoice, they will still make 300% on their money.

Leasing Home

Leasing Home Pros and Cons of Leasing

Pros and Cons of Leasing Getting The Best Lease Deal

Getting The Best Lease Deal Leasing Scams to Avoid

Leasing Scams to Avoid Leasing Software Reviews

Leasing Software Reviews Lease Glossary

Lease Glossary