Why car dealers want to check your background when you pay cash

What to do when this happens to you and pitfalls to avoid

For years we have received questions from car buyers asking us why the car dealer wants them to fill out a credit application when they are paying for their car with cash or a cashier's check. The customer wants to know why the dealer's suspicious action is requiring them to fill out a credit application because after all you are paying cash and not applying for new car financing or any type of loan.

Buying cars is not the same after the 2001 terrorist attacks

We used to say cash is king when buying a new car, but sometimes it does add complications. In this car buying scenario, you are out car shopping and decide you want to avoid financing your new car purchase, and instead you want to pay with cash or a cashier's check, or even a personal check because after all, cash is king.

By the way, car salespeople and dealership finance managers hate it when you pay cash because it robs them of the additional profit of selling car financing, and for dishonest salespeople it removes all the shells in their cash flow shell games. Now they cannot pack your non existing car payments with needless extras.

If you are not financing through the dealer, then unscrupulous car dealers cannot play their shell games and hide the fact that they just stuffed a $3,000 warranty into your deal, spread out and amortized into your 84 monthly payments, because guess what, there are no monthly payments!

Car salespeople will try to do everything they can to stop you from using your own financing, because they want that car loan commission. By paying with cash, you also won't fall victim to their "financing fell through, come back and re-sign new papers" scam 2 weeks later, because there is no financing, no car loan, you paid cash. We are hearing from more and more car buyers all the time who are slapped upside their face with this Spot Delivery financing fell through scam.

Government clamping down on doing business with banned people

In the wake of the September 11 attacks of 2001, the United States Government decided it wanted to really push hard to prevent certain criminal minds from being able to launder money from here to overseas, or to put guns, ammunition, vehicles and other property into the hands of terrorists.

In fact, on September 24, 2001 President George W. Bush signed into effect his Executive Order 13224—Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten To Commit, or Support Terrorism. In other words, we are all required to do our best to prevent the bad guys from obtaining cash or property.

In addition to businesses, I would highly suggest that if you ever sell a car privately, or anything else of value, you should also make sure the person you are dealing with is not sanctioned or blocked. Wouldn't you feel terrible if you saw your used Ford F-150 pickup truck being driven around by ISIS terrorists and killing people?

This weeding out the bad guys is best accomplished with the help of the OFAC’s lists of annexed people, the standard that all businesses use. What is the OFAC? What does a terrorist list have to do with me?

Dealers are required to bounce your name off the OFAC SDN List

This all sounds like a brand soup of complications but we'll educate you on this real fast it's quite easy. The Office of Foreign Assets Control (OFAC) is a division of the US Department of the Treasury, and they administer and enforce economic and trade sanctions against certain foreign countries and regimes, terrorists, drug traffickers, people involved with weapons of mass destruction, and other threats to United States.

The OFAC publishes on their site a frequently updated list currently over 1000 pages long of these banned people and groups called the Specially Designated Nationals and Blocked Persons List; everyone calls it the "SDN." You remember how Santa Claus is making a list and checking it twice? Don't forget Santa maintains a list of who has been naughty, and what a coincidence, so does the OFAC with their SDN list.

Their very long and extensive SDN list contains all the folks around the world who have been naughty and so we are not allowed to do business with them. Businesses such as car dealers are required to bounce your name off the OFAC SDN list and make sure you are not a terrorist, or some other person banned from doing business.

The penalty for non-compliance of the OFAC’s SDN list is huge, and the OFAC fines numerous entities every month. Here is a sample of their SDN list below:

OFAC Specially Designated Nationals (SDN) list of blocked persons

As you look at the Specially Designated Nationals list, I want you to notice that nowhere do you see any Social Security numbers on the list, it is just names. This is because many of the folks are nationals, not in our country and don't have Social Security numbers. Keep this in mind for when we talk about car dealers wanting your Social Security number.

The OFAC made it real easy for you to check the names of people you are dealing with for example when selling your car privately. On their site they have a link to the Specially Designated Nationals List (SDN).

The OFAC may have other sanctions lists as well that the car dealer can check and make sure they don't get a hit, which is a name match with someone on the list. There are also third party software and service platforms that automate this process for car dealers to confirm you are not a terrorist. You get vetted buying a new Vette!

Dealers don't need your Social Security Number to check OFAC list

All they need is a name, not a number. As we showed you above, if you are paying cash and the car dealer checks your name against the OFAC list, you can easily see they don't need your Social Security number, so this is why I say it's bogus when they force you to fill out a credit application when you pay cash.

Other unscrupulous dealers lie and say the "Patriot Act requires you to fill out a credit application", which is just a flat out lie. Also the OFAC requirements were in place years before the Patriot Act. Ever since the early 2000's we here at CarBuyingTips.com have received complaints from car buyers telling us the dealer told them it is required by the Patriot Act when they pay cash.

We warned about this scam in a previous article called Patriot Act Car Dealer Financing Scam.

In that article we advised you how to get a downloadable copy of the Patriot Act and how to search it and there of course is nothing in that PDF file referring to car dealers and credit applications. It's just a lie some of them like to make up because it sounds believable to most people.

We suspect that some of these morally challenged salespeople are just trying to trick car buyers into financing through the dealer and earn a little more profit and commission, or running an unnecessary credit check on cash buyers to sway them into car financing instead of paying cash. Don't let this happen to you.

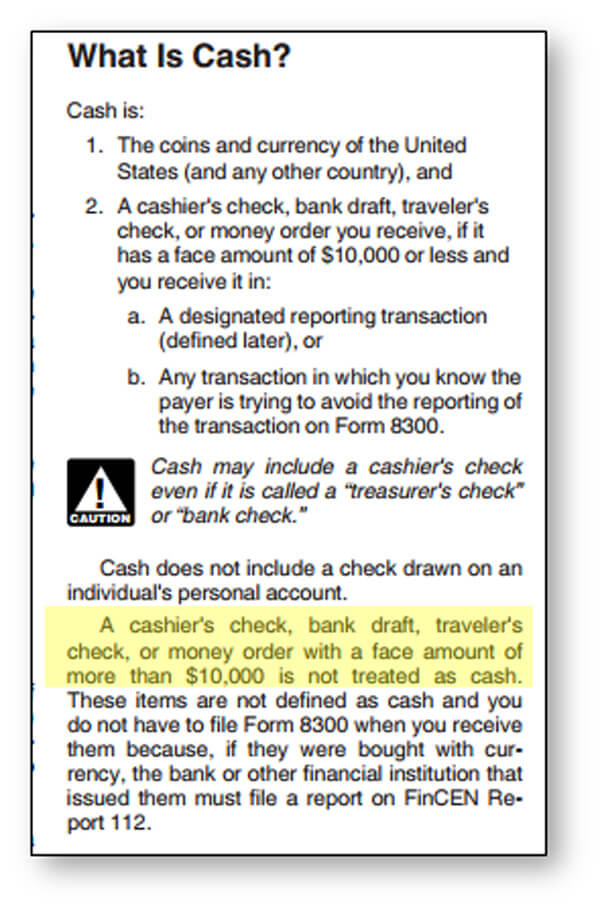

The IRS says you are not paying cash if your check is over $10,000

That seems strange doesn't it? Of course any cash over $10,000 requires IRS Form 8300 to be filled out which is how they trap cash buyers trying to illegally move money around. I call it structuring, where you have say $15,000 in cash, but you illegally structure the deal as say $7,500 cash and $7,500 in a check to avoid the $10,000 cash rule. But the IRS is on to you, they know what you did last summer.

It's a strange game the government is playing here; they are trying to trap people attempting to fly under the radar who are using cash or cash equivalents under $10,000. But the house always wins, they have traps set in place.

The IRS says that if you show up with a mixture of cash and a cashier's check totaling over $10,000, they treat it all as cash and form IRS Form 8300 must be filled out. But for your personal checks and cashier's checks larger than $10,000, which most car purchases are likely to be, the IRS does not consider those as cash, because presumably your bank has already filled out the required forms to the US Treasury's FinCen via Form 112.

Dealers need to know the IRS requirements on cash transactions

What we are trying to do here is help you prove to the car dealer that they don't need your Social Security number if your cashier's check is over $10,000. Just show them the rules from the IRS. Some of these car dealership F&I folks are just not versed properly in the rules. I'm not just blowing hot air, here is a snippet below from the IRS Publication 1544 Reporting Cash Payments of Over $10,000 (Received in a Trade or Business):

IRS Publication 1544 Reporting Cash Payments of Over $10,000

In the photo above you can clearly see that IRS is telling us that "A cashier's check, bank draft, traveler's check, or money order with a face amount of more than $10,000 is not treated as cash. These items are not defined as cash and you do not have to file Form 8300 when you receive them because, if they were bought with currency, the bank or other financial institution that issued them must file a report on FinCEN Report 112."

Right there, the IRS just told the car dealer that any check over $10,000 is not cash, so the dealer does not have to fill out form 8300 and thus does not need your Social Security number. All they need is your name, because that is all the SDN list has on it are names and nothing else.

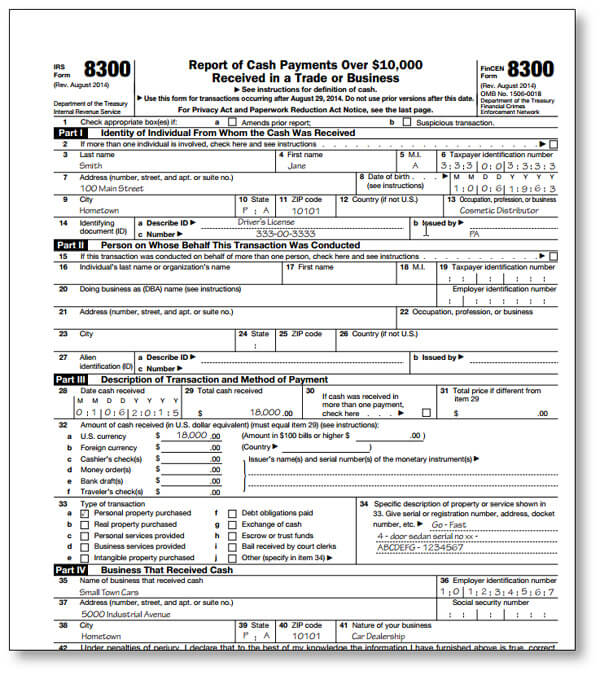

Sounds a bit complex but the result is simple, if your "combination" of cash and cashier's checks is over $10,000, the IRS wants form 8300 filled out and then the car dealer would indeed need your Social Security number. But it should only be directly filled out on Form 8300 and not on a credit application. Hold that car dealer accountable. See the sample of the IRS Form 8300 below:

IRS Form 8300 Report of Cash Payments over $10,000

Our tips to help you avoid complications when paying cash

Don't pay with cold hard cash. Just use a single cashier's check over $10,000 if possible. This avoids the requirement for the dealer to fill out Form 8300, now there's no reason for them to ask you to fill out a credit application or ask for your Social Security number.

If they try to force you to fill out a credit application against your will, simply leave, you don't have to buy the car from them, you can find a less aggressive dealer who will sell you a car without forcing you to fill out a credit application.

If you do decide to fill out the credit application, then somewhere near your signature write down on the paperwork that you are not applying for financing, and they don't have your permission to pull your credit report. If they squawk about it, then you know they were gaming you all along.

For review, remember that car dealers are subject to some strict regulations but they are only required to check your name against the government's list of blocked people. This requirement does not involve them making you fill out a credit application, it only involves comparing your name to a bunch of bad guy's names and that's it.

Be firm and keep the salesperson accountable and always on the defensive with this. Tell them to prove to you how filling out a credit application is required. Have them show you the exact statute that requires you to fill out a credit application. Tell them to put that in writing, because you want to show it to your state attorney general's office for comment. I'm sure all you'll here are crickets, and all you'll get is a song and a dance, but no concrete evidence.

As we have shown you above, any other reasoning they give you is just a scam and you should call them on it. What have you seen when you were shopping for a new car? Let us know.

About The Author: Jeff Ostroff

A lifelong consumer advocate with over 20 years of unparalleled expertise, Jeff is the Founder, CEO and Editor-In-Chief of CarBuyingTips.com. As chief consumer advocate, he oversees a team of experts who cover all aspects of buying and selling new and used cars including leasing and financing.

For decades, Jeff has been the recognized authority on vehicle purchasing, sought out often by the media for his decades of experience and commentary, for live call-in business radio talk shows and is cited often by the press for his expertise in savvy car shopping methods and preventing consumer scams and online fraud. Jeff has been quoted in: CNN, MSNBC, Forbes, New York Times, Consumer Reports, Wall Street Journal and many more.

Jeff also has extensive experience and expertise in new car brokering and selling used cars for clients on eBay and Craigslist. Connect with Jeff via Email or on Twitter.